LloydsDirect is a prominent financial institution that offers a wide range of banking and financial services to individuals and businesses. With a rich history dating back several decades, LloydsDirect has established itself as a leading player in the financial sector, with a strong presence in the United Kingdom and beyond. This institution is renowned for its commitment to customer satisfaction, innovative products, and cutting-edge technology. Whether you are looking for personal banking solutions, business loans, investments, or insurance products, LloydsDirect has something to offer for everyone.

Here are ten important things you need to know about LloydsDirect:

History and Legacy: LloydsDirect has a storied history, tracing its roots back to the founding of the Bank of Scotland in 1695. It has since undergone various mergers and acquisitions, with one of the most significant being the merger with Lloyds Bank in 1995, forming Lloyds TSB. This merger resulted in the creation of LloydsDirect as we know it today.

Diverse Product Portfolio: LloydsDirect boasts an extensive range of financial products and services. These include personal current and savings accounts, mortgages, credit cards, insurance, investment solutions, and business banking services. Its diverse offerings cater to the needs of individual customers, small and medium-sized enterprises, and large corporations alike.

Accessibility and Convenience: With a vast network of branches and ATMs across the UK, LloydsDirect ensures accessibility and convenience for its customers. Moreover, it has a user-friendly online banking platform and mobile app, enabling customers to manage their finances anytime, anywhere.

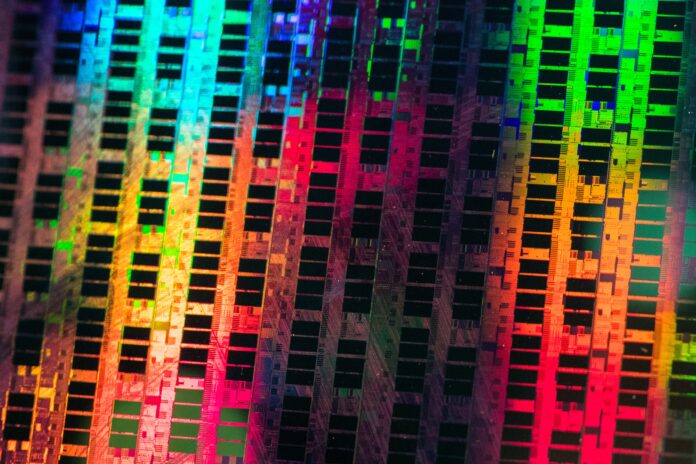

Commitment to Innovation: LloydsDirect is at the forefront of adopting cutting-edge technology to enhance customer experience and streamline operations. It invests heavily in digital initiatives, such as mobile banking, contactless payments, and artificial intelligence-powered customer support.

Corporate Social Responsibility: LloydsDirect takes its role in society seriously and actively engages in various corporate social responsibility (CSR) initiatives. It focuses on environmental sustainability, community development, financial education, and diversity and inclusion.

Financial Stability: As one of the major players in the UK banking sector, LloydsDirect maintains a robust financial position. It is subject to strict regulations and oversight from regulatory authorities, ensuring the safety and security of customers’ deposits and investments.

Strong Customer Focus: LloydsDirect prioritizes its customers’ needs and strives to provide excellent customer service. It offers personalized financial advice and support to help customers achieve their financial goals.

International Presence: While LloydsDirect primarily operates in the UK, it has an international presence through its subsidiaries and global network. This allows it to serve the banking and financial needs of customers with international interests.

Support for SMEs: LloydsDirect recognizes the importance of small and medium-sized enterprises (SMEs) in the economy and offers tailored banking solutions to support their growth and development.

Digital Security and Privacy: LloydsDirect places a high emphasis on digital security and customer privacy. It employs advanced security measures to safeguard sensitive information and combat cyber threats effectively.

LloydsDirect is a leading financial institution with a rich history and diverse product portfolio. Its commitment to innovation, strong customer focus, and corporate social responsibility set it apart in the banking sector. With a wide-reaching network, advanced technology, and a focus on financial stability, LloydsDirect remains a reliable choice for individuals and businesses alike.

LloydsDirect is a prominent financial institution that offers a wide range of banking and financial services to individuals and businesses. With a rich history dating back several decades, LloydsDirect has established itself as a leading player in the financial sector, with a strong presence in the United Kingdom and beyond. This institution is renowned for its commitment to customer satisfaction, innovative products, and cutting-edge technology. Whether you are looking for personal banking solutions, business loans, investments, or insurance products, LloydsDirect has something to offer for everyone.

LloydsDirect has a storied history, tracing its roots back to the founding of the Bank of Scotland in 1695. It has since undergone various mergers and acquisitions, with one of the most significant being the merger with Lloyds Bank in 1995, forming Lloyds TSB. This merger resulted in the creation of LloydsDirect as we know it today. Over the years, the institution has grown and evolved, expanding its offerings and services to cater to the changing needs of its diverse customer base.

One of the key strengths of LloydsDirect lies in its diverse product portfolio. The institution offers a comprehensive range of financial products and services to meet the varied needs of its customers. These include personal current and savings accounts, mortgages, credit cards, insurance, investment solutions, and business banking services. Whether you are an individual seeking a basic savings account or a business owner looking for financing options, LloydsDirect has a solution tailored to your requirements.

In line with the rapidly evolving digital landscape, LloydsDirect has consistently demonstrated its commitment to innovation. Embracing cutting-edge technology, the institution has invested heavily in digital initiatives to enhance customer experience and streamline operations. The launch of its user-friendly online banking platform and mobile app has allowed customers to manage their finances conveniently from the comfort of their homes or on the go. Furthermore, LloydsDirect has explored the integration of artificial intelligence-powered customer support, making interactions with the bank more efficient and responsive.

In addition to its financial offerings, LloydsDirect also takes its role in society seriously. The institution actively engages in various corporate social responsibility (CSR) initiatives, focusing on environmental sustainability, community development, financial education, and diversity and inclusion. By participating in such initiatives, LloydsDirect strives to have a positive impact on the communities it serves and contribute to a more sustainable and inclusive future.

LloydsDirect’s financial stability is another key aspect that sets it apart in the banking sector. As one of the major players in the UK banking industry, the institution is subject to rigorous regulations and oversight from regulatory authorities. This ensures the safety and security of customers’ deposits and investments, instilling confidence in its clientele and stakeholders.

The institution’s strong customer focus is also evident through its personalized approach to banking. LloydsDirect places a high priority on understanding its customers’ needs and providing tailored financial advice and support. This commitment to excellent customer service has garnered the trust and loyalty of millions of individuals and businesses who rely on LloydsDirect to achieve their financial goals.

While primarily operating in the UK, LloydsDirect maintains an international presence through its subsidiaries and global network. This global reach allows the institution to serve the banking and financial needs of customers with international interests, providing them with seamless access to their accounts and services across borders.

LloydsDirect also places a strong emphasis on supporting small and medium-sized enterprises (SMEs). Recognizing the vital role these businesses play in the economy, the institution offers specialized banking solutions to help SMEs grow and thrive. By providing financing options, business advice, and other tailored services, LloydsDirect contributes to the success of many entrepreneurial ventures.

Lastly, digital security and customer privacy are of paramount importance to LloydsDirect. The institution employs advanced security measures to safeguard sensitive information and combat cyber threats effectively. This dedication to data protection ensures that customers can trust LloydsDirect with their financial information and conduct their transactions with confidence.

In conclusion, LloydsDirect stands as a leading financial institution with a rich history, diverse product portfolio, and a commitment to innovation, customer service, and corporate social responsibility. Its wide-reaching network, advanced technology, and focus on financial stability make it a reliable choice for individuals and businesses seeking banking and financial solutions.