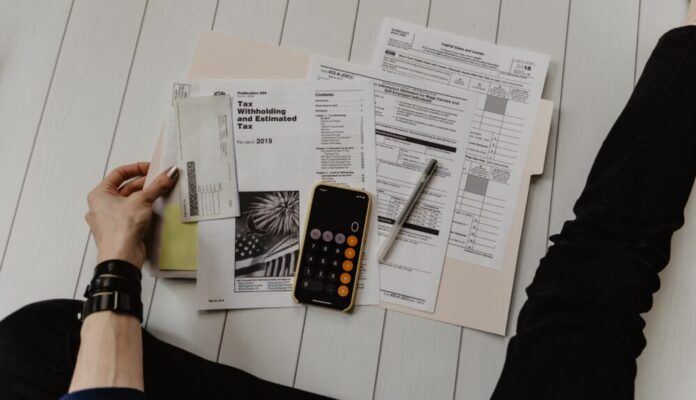

Calculating VAT is one of the most complex financial aspects for US businesses trading with the UK. Unlike US Sales Tax, paid by consumers at the point of sale, UK Value Added Tax is applied at each stage of the supply chain. These charges are usually recoverable for businesses so the customer still bears the cost, but working out how much VAT should be added and reclaimed can be confusing.

Alongside the complication of VAT being a cascade tax, there are different VAT rates to consider and a list of exemptions to check. Errors in calculating VAT can result in charges with interest and a misdeclaration penalty.

Discover how digitalising your approach to VAT compliance can make UK-US trade as easy as domestic deals.

-

Automated calculations

Instead of struggling with the manual method of working out VAT, use digital software for VAT compliance tasks to generate automated calculations. This is a much faster way to find the right threshold and check for exemption. It also speeds up the submission of VAT reclaim forms

-

Enhanced accuracy

Another advantage of automating your tax calculations is enhanced accuracy. Any task that involves people, no matter how knowledgeable they are, allows for human error. Relying on software led by algorithms rather than a physical finance team means you can be sure your calculations are correct every time.

-

Real-time data

Generating VAT reports by hand can take a long time, as can waiting for your refunds to be processed. Specialist digital VAT programs give you access to your real-time financial tax data, including your VAT spend and projected returns. Having an accurate overview of your finances enables you to make informed decisions to further your business while staying in the black.

-

Cost-effective management

Employing a tax specialist can be expensive as their expertise is invaluable in ensuring compliance and evading errors and related fines. Opting for digital software is a more cost-effective way to handle tax management as you only need a specialist to check your reports rather than generating them from scratch.

-

Tracking changes

Even if you make an effort to stay on top of the latest UK tax news, changes to regulations can be easy to miss. VAT software is regularly updated based on the latest guidelines, helping to ensure you stay compliant even in times of changing regulations.

Human involvement is essential to ensuring VAT compliance, but investing in specialist software will streamline your UK-US business endeavours by making your tax calculations quicker and more accurate. Software is also an effortless way to stay up to date with the latest regulations and an easy method to save money.