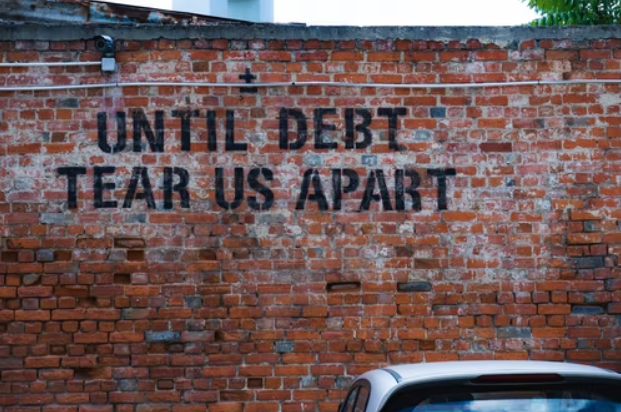

Clearing your debt can become daunting, especially when the debt extends to long periods of repayment. Fortunately, with the right strategy and tools, you can get out of debt. Here are some proven tips and tricks you can use to pay off debt and make the most of your money.

Making a Budget

The first step in your debt pay-off journey is to make a budget. Evaluate your household expenses and try to adjust these essential expenses to a minimum. You can follow the 50/30/20 budget where you would be allocating half of your monthly income to essential expenses, 30% of income to things you want urgently, and at least 20% of the money to pay off debts.Â

After you have made a budget, see whether you can limit your expenses further and increase the repayment amount. By giving more repayments, your debt will be paid off early and you might even get a lower interest rate on increased repayments. You can use credit payoff calculators to estimate the time required to pay off the debt.

Debt Refinancing

One way to tackle debts is by refinancing your debts. Auto loans, student loans, and mortgages can be refinanced so you can pay your debts faster with lower interest rates. You can refinance debt by applying for a debt consolidation loan where you will be given a loan with very low-interest rates. Remember to use a balance transfer card, as they don’t have an APR value.

Declaring Bankruptcy

Two of the most popular ways to get out of debt are to declare yourself bankrupt or go with a consumer proposal. There is a massive difference between a consumer proposal vs bankruptcy, as in a consumer proposal, you will be repaying your debt at rates you could afford while keeping your assets. Whereas, when you declare bankruptcy, you will be handing over your assets equivalent to the credit. There are several other differences between the two. Therefore, spend time on research for better understanding and to make the right choice.

Furthermore, each individual has different financial problems, which require an adequate solution. For example, if you are unemployed, don’t own assets, and are failing consistently in repayments, filing for bankruptcy would be the way to move forward. However, if you own assets, have a monthly income, and can make small repayments to creditors, locking in on a consumer proposal would be the right choice.Â

Staying Committed

The biggest issue while paying off debt is staying motivated. It might be tempting to use tax returns or a stimulus check for your car upgrades or to buy a new gadget. Restrain yourself and stay committed to paying off the debt by using this extra cash from tax returns or another income stream. Direct these extra payments to pay the debt instead of buying something else. Having savings in your bank gives you peace of mind, but money sitting in the bank cannot do you any good. Use your savings to pay the debt. However, remember to keep a rainy-day fund or savings equivalent to two months of your monthly income.Â

Decluttering Your Household

You will be amazed that there are a plethora of household appliances, pieces of furniture, and items that only take up space in your home. Make a list of these items and put them up for sale. You can use the money to pay off small debts easily. It is even possible to find a rare collection of game cards, a vintage toy, or an item holding historical value which can be sold for a good amount to collectors and enthusiasts. You can research decluttering tips to make the process easier and hassle-free.

Debt Financing Services

A debt settlement can be negotiated on your own or through debt settlement services. If you agree upon a debt settlement, there are high chances that you might be paying less than the amount you need to clear. This method of clearing old debts can work in some situations, but it decreases the credit score.Â

Creating additional income streams and cashing your insurance plan to clear debts are some of the other proven ways you can try. The tips mentioned above can be effective in letting you find a way out of debt, but it does not mean each of these tips will work for you. Every individual has varying financial issues, so always consider your requirements, evaluate the debt pay-off options you can utilize, and then start incorporating the tips to get fruitful results.