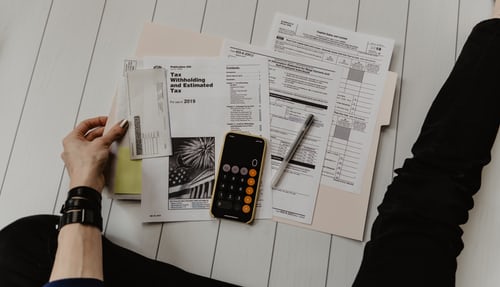

Finances are a big part of any small business, and whether you are already an owner or you are about to set up your own venture, there are certain steps you can take so that you are in the best position. Managing your finances is about so much more than just keeping records and monitoring your income and outgoings. Interested to hear more? Read on as the following are five finance tips for small business owners.

If You Haven’t Already, Create a Budget

Just as you would with your personal finance, budgeting is key for your small business. It lets you see the current position that you are in, and it can also highlight where you may end up in the future. Using an app or creating a spreadsheet usually works best and be sure to be meticulous when it comes to your income and expenditure.

Get your Debt Sorted

To make sure your small business is in the strongest financial position, try to pay off any loans and not carry them forward into the next year. If you already have credit card debt, you can get this under control with a personal loan. Personal loans are also available to enable you to finance your next move and take your small business to the next level. There are many options for personal loans that you can explore and you can get matched with your loan options in less than 60 seconds.

Be Smart with your Money

Every month, you will have different bills to pay, but as these are likely to be due at different times, it can be hard to keep track of them all. Switch your payment method to automated, and this way you can be sure each bill is paid on time. This one small move will allow you to avoid late fees and added interest. If you cannot afford to pay off your credit in full, make sure you are making the minimum payments as not doing so will cause your credit score to decrease.

Have a Contingency Fund

In life, as in business, you can never be sure what is going to happen. For this reason, it always makes good business sense to have a contingency fund at your disposal. Aim to have around three to six months’ worth of your expenses saved up. This means that should you face a month or two with less income or your business is reliant upon the seasons, you will have enough set by to see you through the downtimes.

Don’t Forget to Save for your Future

When you have your own business, it can be tempting to invest everything back into it so that your profits grow, and your business prospers. However great this sounds; you also need to think about your personal future. Do you have a retirement plan? Are you paying into a pension fund? Do you have a savings account? These are all things to think about so you don’t have to stress about your personal finances later on in life.