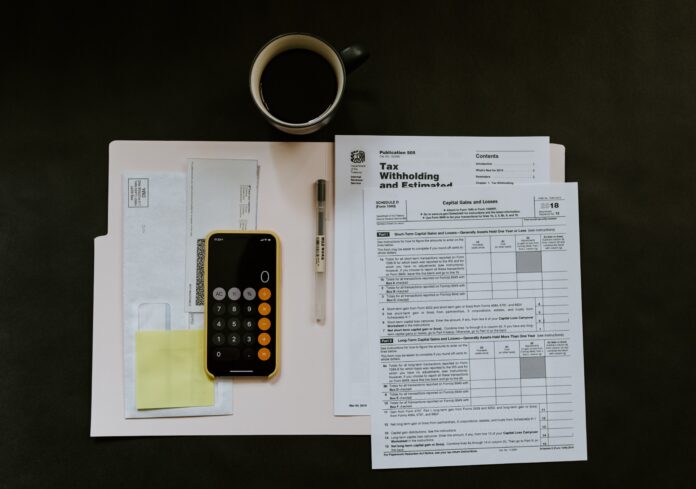

Avalara is a leading provider of cloud-based tax compliance solutions that help businesses automate and streamline their tax processes. The company offers a comprehensive suite of products and services designed to assist organizations in managing their sales tax, VAT (Value Added Tax), GST (Goods and Services Tax), and other transactional taxes. With its advanced technology and extensive tax content database, Avalara simplifies tax compliance for businesses of all sizes, across industries and geographical locations.

Founded in 2004, Avalara has emerged as a key player in the field of tax automation. The company’s primary objective is to relieve businesses from the burdensome task of tax compliance, enabling them to focus on their core operations. Avalara’s solutions are powered by cutting-edge technology, including artificial intelligence and machine learning, which enable accurate and efficient tax calculations, as well as real-time monitoring and reporting.

One of the core offerings of Avalara is its AvaTax product, a cloud-based sales tax automation solution. AvaTax integrates seamlessly with various accounting and e-commerce platforms, automating the calculation and reporting of sales tax for businesses. The software leverages geolocation and address validation technology to determine the correct tax rates and rules for each transaction, taking into account jurisdictional boundaries, product taxability, and exemption rules. This ensures that businesses stay compliant with the complex and ever-changing tax regulations.

In addition to sales tax automation, Avalara provides a range of other tax compliance solutions. Avalara Returns automates the filing and remittance of sales tax returns, saving businesses time and effort. Avalara CertCapture simplifies the management of exemption certificates, allowing businesses to easily collect, validate, and store the necessary documentation. Avalara also offers solutions for VAT and GST compliance, catering to businesses operating in international markets.

Avalara’s solutions are not limited to any specific industry or vertical. The company serves a diverse customer base, including small businesses, midsize companies, and large enterprises across various sectors such as e-commerce, retail, manufacturing, software, and services. By automating tax compliance processes, Avalara helps businesses reduce errors, improve efficiency, and minimize audit risk.

Now, let’s dive into the five key things you should know about Avalara:

1. Comprehensive Tax Compliance Solutions:

Avalara provides a wide range of tax compliance solutions that cover various aspects of tax automation. Its flagship product, AvaTax, simplifies the calculation of sales tax, considering factors like jurisdictional boundaries, product taxability, and exemptions. With Avalara Returns, businesses can automate the filing and remittance of tax returns. Avalara CertCapture streamlines exemption certificate management, ensuring compliance with exemption rules. The company also offers solutions for VAT and GST compliance, catering to businesses operating globally.

2. Integration and Scalability:

Avalara’s solutions seamlessly integrate with popular accounting, e-commerce, and point-of-sale platforms, making it easier for businesses to incorporate tax automation into their existing systems. This integration minimizes manual data entry and reduces the risk of errors. Avalara’s solutions are also scalable, accommodating the needs of businesses of all sizes, from small startups to large enterprises with high transaction volumes.

3. Accurate Tax Determination:

With its extensive tax content database and advanced technology, Avalara ensures accurate tax determination for each transaction. The software leverages geolocation and address validation to identify the correct tax rates and rules, considering multiple jurisdictional boundaries. Avalara continuously updates its tax content to keep up with the ever-changing tax regulations, ensuring businesses stay compliant.

4. Global Reach:

Avalara recognizes the needs of businesses operating in international markets. The company offers solutions for VAT and GST compliance, allowing organizations to handle the complexities of cross-border transactions. Avalara’s global tax expertise and localized content enable businesses to comply with tax regulations in multiple countries, simpl Avalara’s global tax expertise and localized content enable businesses to comply with tax regulations in multiple countries, simplifying their international operations. Whether it’s navigating the European Union’s complex VAT system or understanding the intricacies of GST in countries like India or Australia, Avalara provides the necessary tools and knowledge to ensure compliance across borders.

5. Constantly Evolving and Innovating:

Avalara is committed to continuous improvement and innovation in the field of tax compliance. The company stays up-to-date with the latest tax regulations and updates its software accordingly. Its team of tax experts closely monitors changes in tax laws and incorporates them into Avalara’s solutions, relieving businesses of the burden of constantly keeping track of tax changes. Additionally, Avalara invests in advanced technologies such as artificial intelligence and machine learning to enhance the accuracy and efficiency of its tax automation solutions.

Avalara is a leading provider of cloud-based tax compliance solutions that help businesses automate and streamline their tax processes. With a comprehensive suite of products and services, Avalara simplifies tax compliance, ranging from sales tax automation and returns filing to exemption certificate management and global VAT/GST compliance. The company’s solutions integrate seamlessly with various platforms, ensuring accurate tax determination and minimizing errors. Avalara’s commitment to innovation and global tax expertise makes it a reliable partner for businesses of all sizes, enabling them to focus on their core operations while staying compliant with tax regulations.

Avalara’s comprehensive tax compliance solutions offer businesses a complete suite of tools to handle their tax obligations efficiently. Their flagship product, AvaTax, is a cloud-based sales tax automation solution that seamlessly integrates with accounting and e-commerce platforms, automating the calculation and reporting of sales tax. By leveraging geolocation and address validation technology, AvaTax ensures accurate tax rates and rules are applied to each transaction, considering jurisdictional boundaries, product taxability, and exemptions.

Another crucial offering from Avalara is their Returns solution, which simplifies the filing and remittance of sales tax returns. Businesses can automate the entire returns process, saving time and effort while reducing the risk of errors. Avalara’s Returns solution supports various filing requirements and integrates with tax authorities to facilitate seamless compliance.

Avalara CertCapture is yet another valuable tool provided by the company. It simplifies the management of exemption certificates, which are necessary for businesses to exempt specific transactions from tax. With CertCapture, businesses can easily collect, validate, and store exemption certificates, ensuring compliance with exemption rules and reducing the risk of non-compliance during audits.

Avalara also recognizes the global nature of business operations and offers solutions for VAT and GST compliance. These solutions enable businesses to handle the complexities of cross-border transactions, ensuring compliance with international tax regulations. Avalara’s global tax expertise and localized content help businesses navigate the nuances of VAT and GST in different countries, enabling them to expand their operations globally while maintaining tax compliance.

In addition to their comprehensive product offerings, Avalara’s commitment to integration and scalability is worth noting. Their solutions seamlessly integrate with various accounting, e-commerce, and point-of-sale platforms, making it easier for businesses to incorporate tax automation into their existing systems. This integration minimizes manual data entry and reduces the risk of errors, providing businesses with a streamlined and efficient tax compliance process. Furthermore, Avalara’s solutions are scalable, catering to businesses of all sizes and accommodating high transaction volumes.

Avalara’s dedication to accuracy and innovation is evident in their advanced technology and continuous improvement efforts. Their software leverages artificial intelligence and machine learning to enhance tax calculations, ensuring accurate and efficient tax determination. The company’s team of tax experts closely monitors changes in tax laws and regulations, updating their solutions accordingly to ensure businesses stay compliant. By investing in advanced technologies and staying ahead of evolving tax requirements, Avalara remains at the forefront of tax compliance innovation.

In conclusion, Avalara is a trusted provider of cloud-based tax compliance solutions that empower businesses to automate and streamline their tax processes. With a comprehensive suite of products and services, including AvaTax for sales tax automation, Returns for streamlined filing, CertCapture for exemption certificate management, and solutions for global VAT and GST compliance, Avalara caters to the diverse needs of businesses across industries. By offering integration and scalability, maintaining accuracy, and investing in innovation, Avalara simplifies tax compliance, enabling businesses to focus on their core operations while staying compliant with tax regulations.